In relation to purchasing a motor vehicle, lots of men and women look at the choice of shopping for from the used car or truck dealership. This choice is often determined by the need to save cash, as utilized cars commonly come in a lower cost level than brand-new kinds. A highly regarded utilised automobile dealership offers a wide selection of automobiles which have been carefully inspected and they are Completely ready for resale. This offers potential buyers comfort being aware of the car or truck They can be investing in has undergone demanding checks to ensure its dependability. The appeal of used automobiles is not only restricted to their affordability; it also extends to the variety of types available, allowing buyers to find a vehicle that fulfills their unique needs and Tastes. Regardless of whether anyone is looking for a compact auto for city driving or a larger SUV for relatives outings, a utilized car dealership is probably going to own several choices that in good shape the Invoice.

The whole process of paying for a auto from the used auto dealership usually involves the necessity for motor vehicle loans. These loans are critical for individuals who do not have the indicates to purchase a car outright. Quite a few utilized car dealerships present funding possibilities to create the paying for course of action smoother for their consumers. Car loans are usually structured in a means that allows consumers to repay the price of the car or truck after some time, which makes it less complicated to control monetarily. Curiosity fees on car loans can differ depending on the buyer's credit score background, the loan time period, plus the lender. It is important for likely potential buyers to very carefully think about the terms with the mortgage prior to committing, as this will have a big impact on their money obligations from the years to come back.

For anyone having a much less-than-perfect credit history record, securing funding through undesirable credit car financial loans may very well be important. Undesirable credit history auto financial loans are specifically built for individuals that have struggled with credit rating concerns in past times. These loans ordinarily have increased desire costs due to the improved risk perceived by lenders. Nevertheless, they provide a possibility for those with bad credit score to rebuild their credit score when still obtaining the car they will need. When working with a applied vehicle dealership, it's actually not unusual to search out financing options personalized to accommodate customers with terrible credit score. These dealerships realize the issues faced by people with bad credit and infrequently companion with lenders who specialise in bad credit score automobile loans, guaranteeing that more people have use of the cars they need to have.

One more critical consideration when buying a employed car or truck is the opportunity of auto refinancing. Vehicle refinancing permits automobile homeowners to replace their present-day vehicle mortgage with a new 1, most likely securing improved conditions like a decrease interest charge or a far more workable month to month payment. This can be used car dealership notably effective for those who originally took out terrible credit rating motor vehicle financial loans but have considering the fact that improved their credit score rating. By refinancing, they might be able to lower their financial stress and lower your expenses above the lifetime of the personal loan. Used car or truck dealerships often get the job done with refinancing experts to help you their shoppers examine these possibilities. The objective of vehicle refinancing is to make car possession additional inexpensive and sustainable in the long run, enabling individuals to keep up their financial wellness even though continue to experiencing the key benefits of possessing a car or truck.

Within the utilised car or truck sector, bad credit car loans the availability of assorted funding options, which includes auto loans and terrible credit rating motor vehicle financial loans, is important for guaranteeing that a wide array of vehicle refinancing customers can accessibility the automobiles they want. Utilized car dealerships Participate in a big position in facilitating these transactions by providing adaptable financing methods and partnering with lenders that are prepared to get the job done with consumers of all credit history backgrounds. The option to go after car refinancing further more enhances the enchantment of buying from a applied automobile dealership, as it offers a pathway for buyers to enhance their economical scenario eventually. By cautiously thinking of all of these aspects, men and women may make educated selections when obtaining a made use of car, guaranteeing that they discover the proper car in a price tag they could manage.

Devin Ratray Then & Now!

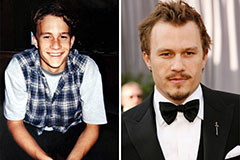

Devin Ratray Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!